Baseball is dominating my family calendar these days. With the NBA Finals wrapped up, school out, and summer officially here, we’ve fully entered ballpark season. (Humblebrag incoming…) My two oldest boys made the Newburyport All-Star teams, which means we’re spending five or more nights a week at fields across eastern Massachusetts. Dugouts, sunburns, and post-game slushies are now part of our summer rhythm, and I wouldn’t trade it for anything.

With baseball at the forefront, I’ve been thinking about how the strategies that reshaped the sport, thanks to the now-famous “Moneyball” approach, have a lot to teach us about investing, especially when building a balanced retirement portfolio.

Moneyball and the Myth of the Home Run

You probably know the story. The Oakland A’s, working with a limited payroll, embraced data analytics and shifted their focus from star power to one key stat: getting on base. They stopped swinging for the fences and started aiming for consistency. That mindset? It applies directly to portfolio strategy.

Diversified Investment Strategy – The Power of Quiet Consistency

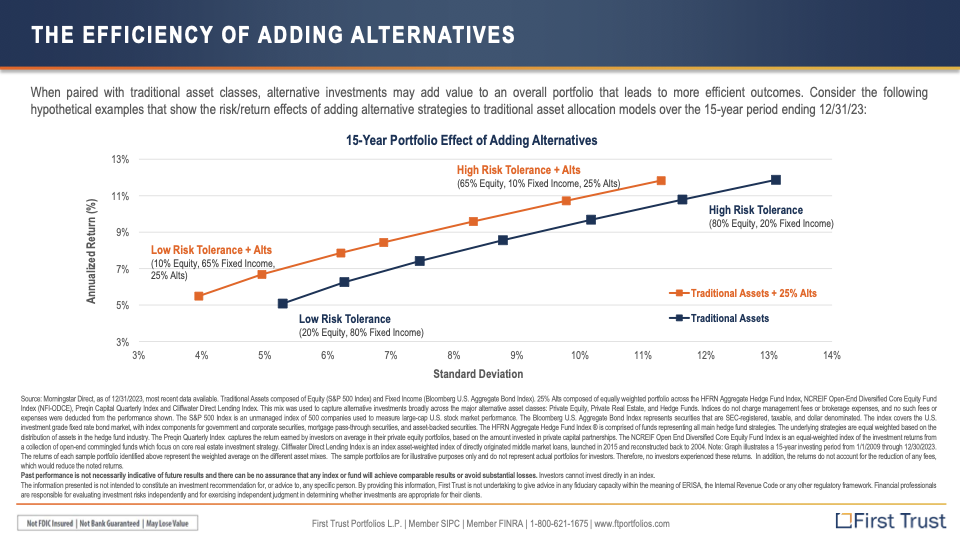

In the investing world, many assume the goal is to find the next big thing. Some go for the breakout stock that will triple in value overnight. That’s the home run mentality. But often, long-term success is about avoiding outs, not chasing highlight reels. It’s about getting on base; this is where a well-constructed portfolio shines. The goal isn’t just performance; it’s consistency. Lower drawdowns. Smoother rides. Fewer surprises.

Does that sound flashy? No. But can it help you work towards financial goals? Yes.

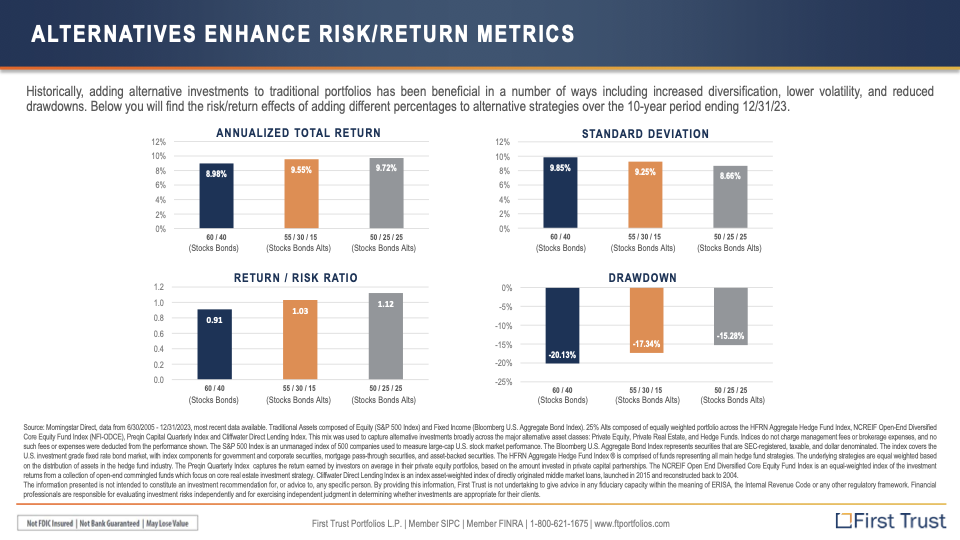

The Modern Portfolio vs. the Traditional 60/40 Split

Think of the traditional 60/40 stock/bond portfolio like a slugger who hits 25 homers but strikes out a lot. It looks good on paper until everything starts moving in the same direction, as we saw in 2022 when both stocks and bonds declined by double digits.

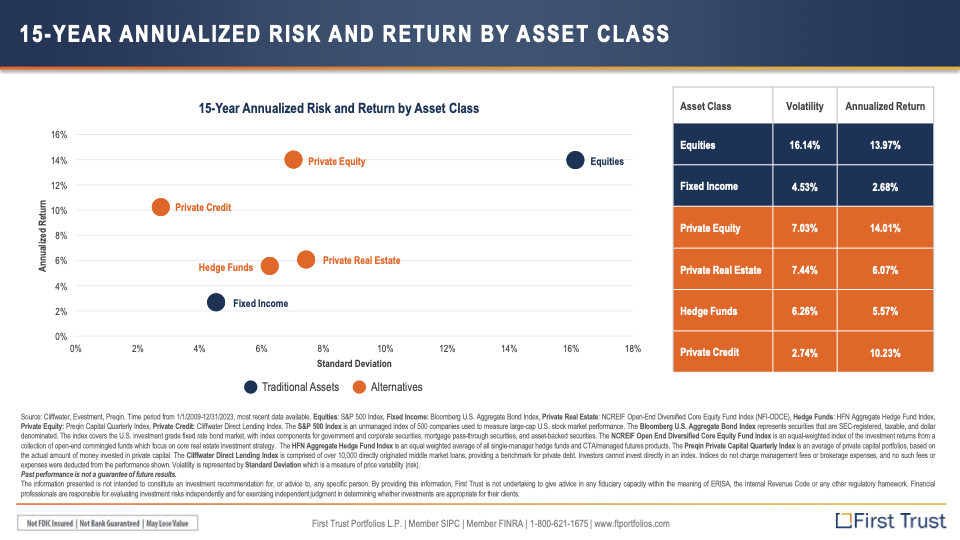

Now, picture a lineup filled with players who can get on base: diversified investments which could include, if suitable, real estate, hedge strategies, and alternatives. Not headline-makers, but reliable contributors. That’s how you can build a resilient, high OBP (on-base percentage) portfolio.

What About Risk? What About Compounding?

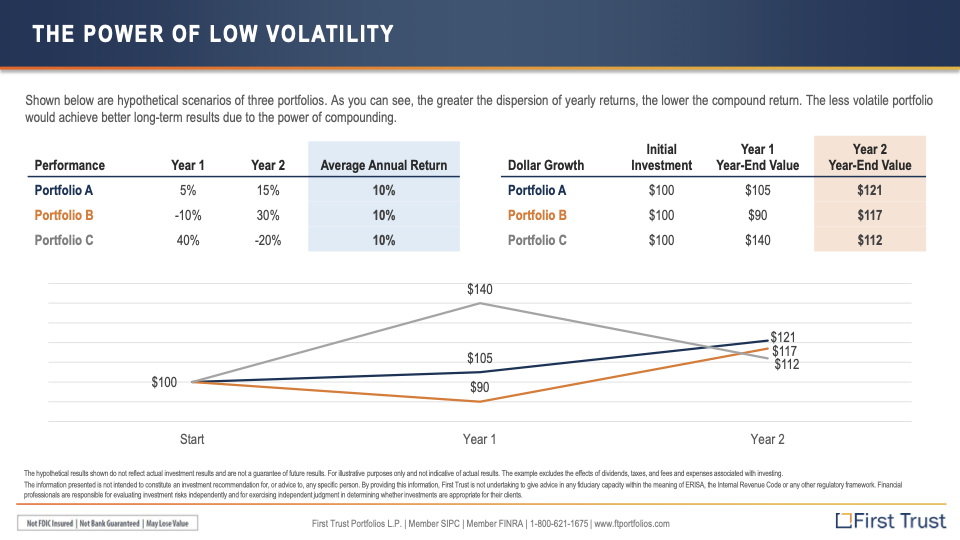

Even if different portfolios produce similar average returns, higher volatility can make it harder to maintain steady growth over time. Just like three hitters might finish a season with identical batting averages, the one who shows consistent seasonal performance throughout often feels more dependable when the pressure’s on.

In retirement planning, that’s the portfolio you want.

Building a Lineup, Not Buying a Lottery Ticket

Flash doesn’t compound. Consistency does. So if your portfolio is still trying to hit home runs every year, maybe it’s time to revisit the playbook. Because in retirement, like in baseball, the wins come from stringing together base hits, not swinging for the fences every time.

As an experienced family financial planner, whether you want to discuss your portfolio’s OBP or just chat about All-Star season, book a call; my door is always open, and I’m always delighted to help people find new avenues to work towards their financial goals.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.