It’s hard to imagine that just a few decades ago in the 1980s, the average household income was barely more than $50,000.

Nowadays thanks to surging populations in the metro Boston area, combined with inflation and several economic crises, this would be extremely difficult for a family living in a large city in the US to survive off of while living a middle-class lifestyle.

Here’s our current financial reality. In order to raise a family and live a modest, middle-class lifestyle, your family needs to bring in at least $350,000 per year. Whether that’s from one person with a lucrative job or with both spouses working, $350,000 is about the minimum for popular cities in this country.

The problem here is that despite inflation, rising rent prices, increasing college tuition, and a higher cost of living, the median wealth of middle-class Americans has plateaued around the mid- to upper-70k mark.

Of course, there are cities where you can make less and still live the lifestyle you want. You and your family can certainly find a way to live on less, but without at least $350,000, your contribution to education, retirement, and savings accounts will suffer.

In this post, we’re also going to go over some tips on how to increase your wealth and sustain you and your family’s lifestyle — or find alternatives that still allow you to hit your financial goals while living the life you want.

Getting to $350,000

While $350,000 seems like a fortune to many just beginning their career or supporting a family by yourself, it’s certainly not an impossible goal. As you move up the corporate ladder, many professionals, business people, entrepreneurs, and more can get work their way to earning that much money.

This can take many years of dedication and hard work in the same field. Once you reach that, though, you’ll also likely be receiving other company perks and amenities that can help reduce your spending, too.

However, this is obviously a much more attainable goal when there are multiple earners in the same household. Instead of relying on a single person to make that much, combining two or more incomes makes it much easier to get you there.

Considering moving to a one-income household?

Learn more about this in our article: “Can You Afford to Have One Spouse Working?”

Dual-Income Example

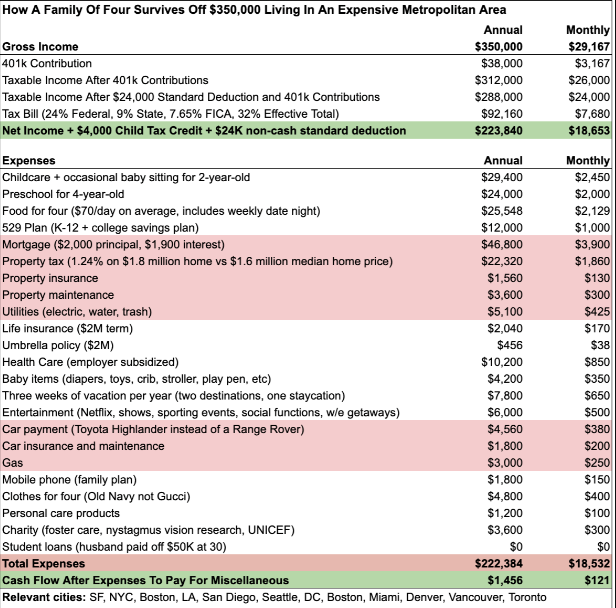

Let’s look at a four-person family with two parents and two children where they do make $350,000 per year with both parents working.

Here’s a breakdown of their income:

- Each parent puts away $19,000 in their individual 401(k). This adds up to $38,000 a year for 401(k).

- They have a $24,000 tax deduction and pay $92,160 in total taxes.

- Because they earn less than $400,000 per year, they receive a $2,000 tax credit for each child. This adds $4,000.

When taking into account their expenses, their annual cash flow ends up being just about $1,500… which isn’t that much for a family of four. Almost all of their money will go towards expenses and education with their retirement savings lacking and not much money left for investments or other forms of income.

In order for this couple (and other similar couples) to get to the financially independent state they’re looking for, we would say that they need to increase their overall worth to be at least 25 times annual expenses or 20 times their annual gross income.

Five Suggestions to Get You Where You Need to Be

Obviously, those numbers are even more daunting than perhaps even the $350,000 was. It’s tough to get there when you have little income leftover for savings or for furthering your education to earn more income.

That being said, we’re in the business of helping you understand these things, not scaring you or stressing you out. So, if you’re struggling to make the money you need in your city, here are a few financial planning suggestions that we give our clients to help you out:

1. Stop Shaming Yourself

Parents have so much pressure themselves these days. Some financial planners would suggest you eat dog food or take on a second job in order to save 15 percent of your income. So what happens? You feel bad for not doing “enough.”

Don’t worry, though. You can still improve your financial situation without feeling shamed.

This is a good chance to take an honest assessment of your progress and make a plan to survive the moment without sacrificing your future. Are you on track? Ahead of where you need to be?

Understand that there are some very expensive stages of raising a family — when the children are young and again when they are in college are 2 examples. That’s just a reality, and it’s nothing to be ashamed of.

To put things in perspective, if you are running the Boston Marathon and approaching Heartbreak Hill, you better not be thinking about the finish line! Now is the time to take it step by step until you reach even ground.

Take a step back and see if you could afford to TEMPORARILY reduce what you put in your company retirement plan to the level they match your contributions. Also you might not put enough in the 529’s while you are paying for a nanny. Be sure once the nanny is no longer necessary to use those dollars to catch up instead of a big vacation or luxury car.

This may be the only time you hear a financial planner to tell you it is OK to save less. This should not be done if you are still going on $15,000 vacations 🙂

2. Build an Investment Portfolio

As we mentioned earlier, even earning the minimum $350,000 isn’t always enough. It could be enough to live each year, but it isn’t always enough to build substantial savings accounts, building net worth & retirement funds, paying for education, etc.

Passive investment income is one of the best ways to increase your wealth and get on your way to eventual retirement with financial freedom. Especially if you only have a 401(k) for retirement, a great investment portfolio can support you and your financial plans.

3. Give Up on the “Middle-Class Lifestyle”

Who says that you have to live in that trendy and expensive city? Who says you need a house with three rooms and a gym? Is that vacation and spa trip necessary? Do you really want to do these things, or are they just expected from you as a member of the middle class?

There are no rules for life. Perhaps a middle-class lifestyle in a nice, coastal city is worth the financial planning and some elements of sacrifice for you.

But if you find yourself not caring or having other lifestyle goals, live your truth! There’s no use struggling with money or scrambling to make enough money to support your family if you’re living a life you don’t want or need.

4. Move Somewhere Else

Continuing on with the ideas from #3, moving somewhere else (read: somewhere more affordable) is a perfectly acceptable and valid decision!

Moving away from the coasts and from the heavily populated areas can significantly reduce your expenses, rent, mortgages, and necessary income.

For example, in Boston, a two bedroom apartment requires an average minimum salary of over $87,000. Moving away from the coast and deeper into the state in Worcester significantly reduces that salary requirement to an average of about $48,800.

Moving to a new city may reduce your income, but it also significantly reduces the income you need as well as your overall expenses.

5. Stay on Top of Your Finances

We understand that grappling with your finances, especially as a parent or a newly married couple, is stressful. Resist the urge to push it off until later or purposefully avoiding looking at your bank statements.

Making a plan and staying on top of your income, your assets, your expenses, and your family’s needs & lifestyle is going to be the most essential step you take on your journey to financial freedom. Work with someone with experience to understand what life could look for you financially in 3-5 years based on your goals. Will your house be suitable for you as your family grows? What are the schools like? The list goes on.

Financial Planning That Works for You

Financial requirements and responsibilities are only going to increase as time goes on. Between inflation, strange economic times, and rising costs of living almost everywhere, it can be a stressful time to be a parent, a homeowner, or even just someone trying to get by.

We’re here to help, and we hope that this article got you thinking about ways you can take control of your finances and move towards a sustainable lifestyle.

We can do more than provide tips, though. We have years of experience working with people at all walks of life. We can help you make a budget that works for you and your family, provide investment suggestions, and help you gain a better overall understanding of your finances in the short and the long-term.

Ready to get to living the life you want? Contact us today to learn more and ask questions. That’s what we’re here for.