We often discuss planning, saving, contributing, and the wide range of various things that go into a proper financial plan; however, we only once in a while talking about EXACTlY how to set up everything. At the end of the day, how would you set up a financial framework that sends cash to the correct places and keeps everything coordinated without you losing your brain or leaving your place of employment just to monitor everything?

That is precisely what we will discuss today.

Building Financial Framework

I will share the framework I use myself and the one I prescribe to my clients.

This is how I set up my financial accounts and move cash around to ensure that my investment funds objectives are met and my bills are paid, all with as minimal continuous work as could be expected.

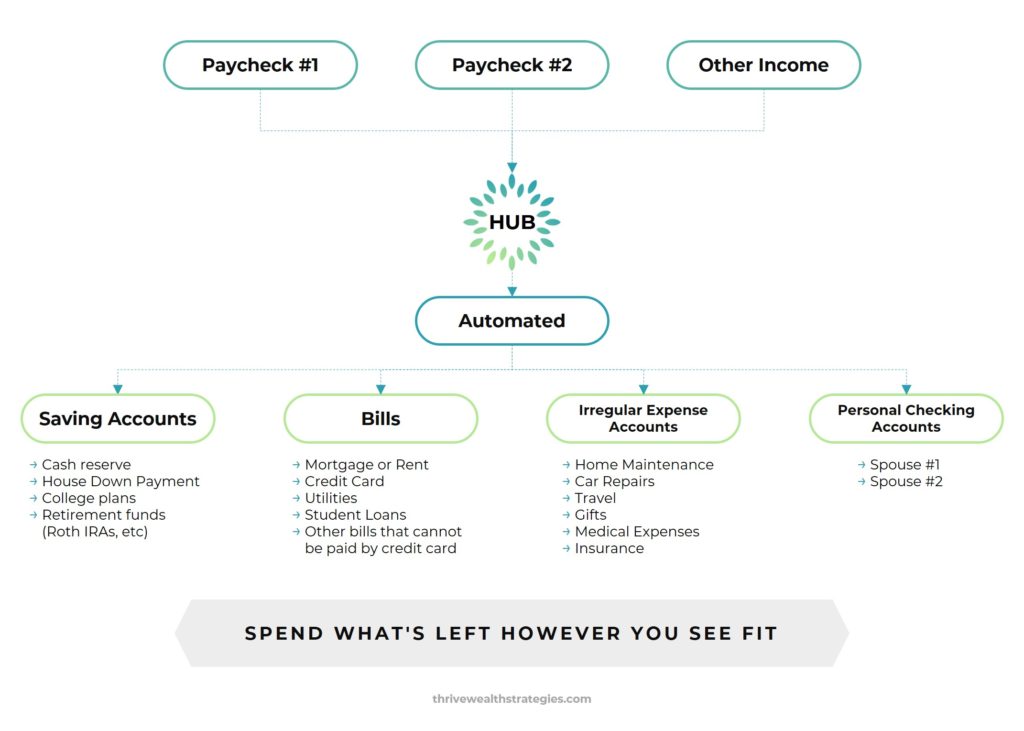

Automated Financial Hub

I considered calling this the Self-Driving Financial Hub since it’s intended to be pretty much automated as could be expected and because I’ve been obsessed with self-driving vehicles as of late (humor me!). After I ran it by my wife, I came to the realize that I am not nearly as creative as I had originally thought.

I’ll clarify each illustration beneath; however, before you get anxious, realize that it’s intended to make your life much more straightforward. Regardless of anything else, this framework is designed to be:

Prioritization: It coordinates cash towards the things you care about most.

Low-effort: For the most part, this framework runs itself, assuaging you of a large part of the weight of taking care of your everyday funds.

Cooperative: It cultivates joint effort among you and your companion, making it simpler to cooperate towards your shared objectives while likewise safeguarding some individual opportunity.

In this way, we should plunge into the subtleties and perceive how everything functions!

The suspicion here is that you’re working with a partner, yet the essential framework remains constant for different circumstances.

Step 1: Deposit all pay into one shared fund. I call this your “HUB.”

The initial step is guiding all your pay to a joint account with online bill pay features.

You can think about this as the “HUB” of your monetary framework. All your cash comes into this account first before being siphoned out to different specified places.

Presently, certain things like 401(k) commitments and health care coverage charges will be removed right from your check. That cash won’t ever contact the HUB, and that is alright.

Saving the entirety of your pay into a HUB will keep things straightforward for you. You’ll generally realize precisely how much cash is coming in and when to anticipate it, and it will be not difficult to both set up the automated transactions we’ll discuss and revisit them down the line as your objectives and necessities change.

Also, it’s a joint account since you’re a group and you’re cooperating towards shared objectives. Yet, don’t stress; there’s a stage beneath that gives you each some opportunity to have some autonomy with a bit of cash all alone.

Step 2: Pay Yourself First

Another cliche? Sorry, I can not help myeslf. Pay yourself first is a maxim you’ve presumably heard previously, and it’s a decent one to live by.

Paying yourself first methods putting cash towards the things you care about most BEFORE sending it to others. Furthermore, practically speaking, it implies automating your investment funds towards your most significant objectives before taking care of all your different bills and costs.

It resembles this:

Refer to your financial plan and choose the amount you need to put aside toward each goal and which account(s) you’ll use to accumulate those funds.

Set up automated exchanges that move that cash from your HUB to your different bank accounts every month.

Timetable these exchanges to happen just after receiving your check every month BEFORE your other spending has occurred.

Setting it up this way makes sure that there’s consistent cash to save and that it happens every month, which means you’re gaining reliable headway towards the future you have planned.

Step 3: Automate your bills

The less you need to remember, the better. Automating your bills takes one primary concern off your plate by guaranteeing that all of your bills are paid on time every month.

There a few distinct approaches to do this.

You can pay numerous bills consequently with credit cards. If you’re similar to me and like to utilize credit for your spending to get those sky miles, you can presumably deal with most bills this way. Please make a point to set it up to auto-pay in FULL every month!

I have two credit cards – one for family expenses and one for business expenses. This separation helps me organize them and saves me many hours come tax time.

You can’t take care of different bills with a credit card, or you may just not have any desire to utilize credit, and all things considered, you can automate them through your joint financial checking Bill Pay framework.

In any case, automating them ensures that they’re constantly paid in full on schedule and completed without you in any event, considering everything.

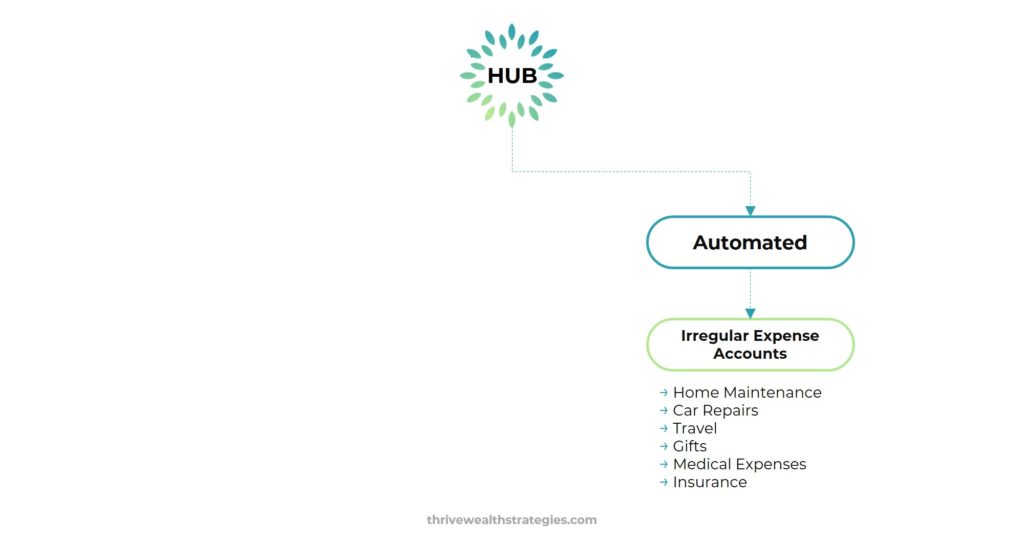

Step 4: Plan ahead for unpredictable costs

You realize that feeling when the vehicle begins shaking, and you don’t have a clue where the cash to fix it will come from? It’s unpleasant, yet fortunately, you can keep it from occurring.

By saving ahead for unpredictable costs, you can feel confident that the cash’s there when you need it. Rather than freezing and scrambling to fit that vehicle fix into your spending plan, you can essentially remove the money from reserve funds.

Start with standard unpredictable costs like vehicle fixes, home upkeep, travel, gifts, medical costs, and annual expenses. You may not remember all of these right away, but update the automated plan as the annual bills come in.

Learn How a Family Financial Planner Can Help Build Financial Framework

A decent criterion is any significant enough cost to upset your financial plan that happens sporadically enough not to be a continuous piece of your month-to-month spending.

Gauge the amount you spend on every classification in a given year. Some banks will provide you with an estimation, or you can ask me for a few free budgeting programs I have tested out.

Add all of these up and divide by 12 to get a month-to-month sum. Set up an automated exchange that moves that sum into a savings account every month.

At the point when one of these costs comes up, essentially move the cash from your savings account to your HUB, and you have it covered!

I like to start this account (if possible) with one year worth of unpredictable expenses or work to get there as quickly as possible.

Likewise, you could utilize a second HUB for a cash reserve account and monitor how much cash is assigned to every unpredictable cost on a bookkeeping page.

Regardless of how you do it, getting ready early for these unpredictable costs will make your life significantly more straightforward, and automating that readiness takes one more concern off your plate.

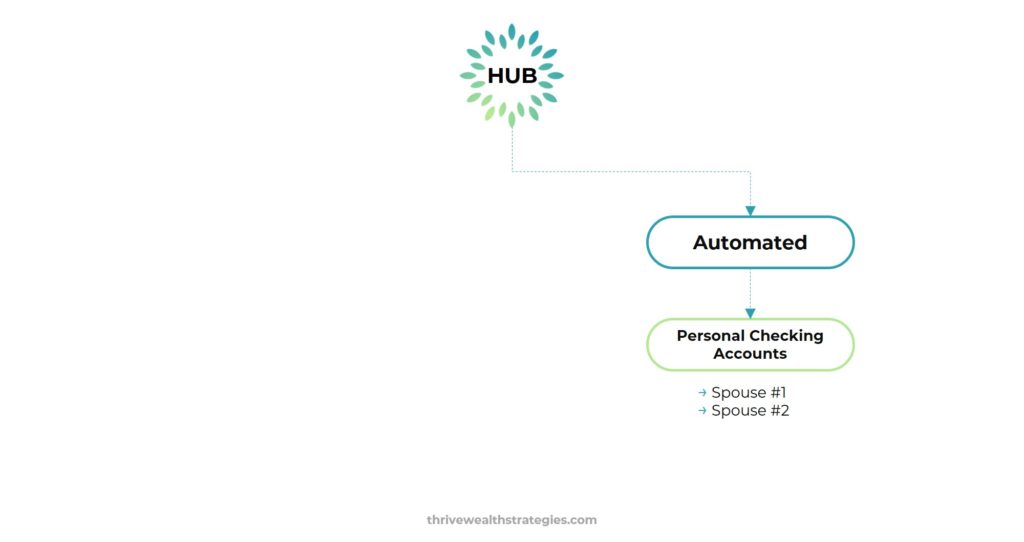

Step 5: Give each other some freedom

This is the place where you will save your fun money inside this joint monetary framework.

Notwithstanding your HUB, I urge you to open separate individual accounts and naturally move some cash to each consistently. That cash is then accessible for you to each spend or save however you see fit.

I would urge you not to follow how this cash is spent as a feature of your joint financial plan. This isn’t tied in with being secretive from one another, however essentially about permitting every one of you to settle on close-to-home spending choices without defending them. Whether it is for baseball cards or a spa day, you need some freedom to have some fun money.

This will also allow you to buy gifts without giving away the surprise. Just don’t do it on Amazon as I did for Mother’s Day 🙄.

I’ve advised many individuals who’ve credited this technique for soothing a ton of the financial pressure in their relationship. There are still many choices for you to make together, yet this ensures that there’s in every case some cash that is only yours.

Step 6: Spend the rest however you see fit

With the entirety of the essential things previously taken care of, the solitary genuine choice you need to make every month is how to go through the leftover cash.

What’s more, best of all, since you’ve effectively saved and covered every one of your bills, you can go through that cash righteous!

Without a doubt, there will, in any case, be some intense choices like the amount to spend at Market Basket (or, if the budget allows…. WholePaycheck) versus eating out. However, there’s no worry over ensuring there’s cash left over toward the month’s end to save or put towards obligations. There’s no blame when you need to enjoy a tad. The money that is left over is yours to spend however you see fit.

It’s likewise a decent planning hack since you know precisely how much cash you have accessible to spend AFTER your commitments are dealt with. It makes all the psychological bookkeeping significantly simpler.

Try it out

This sort of framework will set aside some effort to set up, and there might be a few struggles as you become acclimated to how everything fits together.

Be that as it may, it does practically the entirety of the hard work for you when automated. Bills are paid, investment funds are made, and potential spending busters are taken care of early, all without you doing a thing.

So what do you think? Could you see yourself utilizing a HUB like this? Is there anything you’d change?

If you found this article helpful, please read our blog “Can You Afford to Have One Spouse at Home.” Many families wonder whether or not they can meet their financial goals with one spouse working, and this piece will help provide some perspective for families facing this dilemma.