Let me paint you a picture. It’s day 3 of a 7-day school vacation week in February, and my wife and I are coming off a few no-school snow days; we’ve exhausted every indoor and outdoor entertainment option that my four kids will humor – we’re starting to lose some grip on reality. And then, it hits us; the kids have at least two more full school vacation weeks before summer vacation begins; what will save our sanity? How do we avoid more days like this in the future?

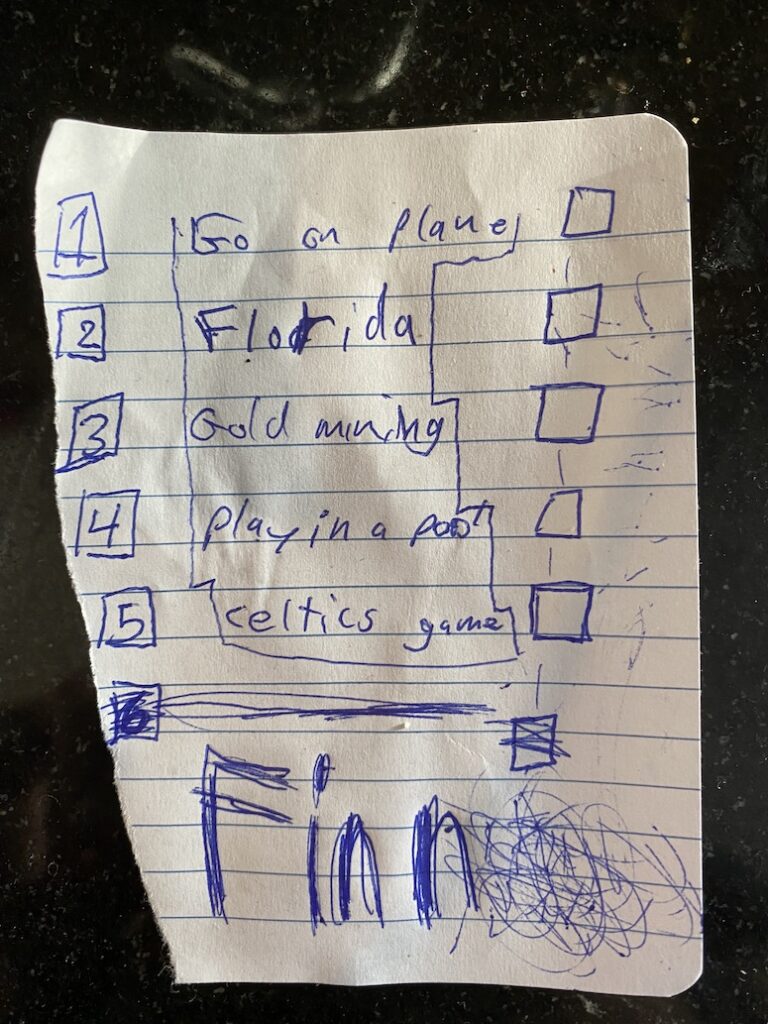

My eldest, Finn, actually questioned his younger brothers about what they’d want to do if they could go on vacation – see results/pictures below:

Suddenly, the idea hits us like a bolt of lightning sent from Orlando, Fl, directly to our minds – If we can’t keep them entertained with mounds of toys, books, and attention, perhaps we need to call in the big guns…Mickey! Yes, the mouse and his enchanted world of unlimited entertainment, magic, and fun, that’s the answer!

How Much Does a Trip to Disney Cost?

Of course, as a family financial planner, I started running the numbers even before my wife and I even acknowledged a trip to Disney World was a shared goal. My goal was to grasp how much a trip to Disney costs these days for our own purposes but also to understand whether a trip to Disney every few years was still an attainable goal for middle-class families living a middle-class lifestyle.

In this blog, I will run through some numbers with you and cover some strategies for planning family trips.

This blog is the third entry in my “Don’t Skip The…” series, as it’s a philosophy that is near and dear to my heart. I don’t want to think families are skipping out on making priceless memories only because of a lack of perspective and understanding of their financial situation.

Let’s Talk Disney Numbers

So, after some digging into the trip, including flights, hotel on the property, theme park passes, food, and the inevitable souvenir purchasing, I’ve estimated that for a 10-day trip for my wife and myself and all four kids (one being under 2), the trip will cost between an estimated $9k-$13,000.

I know, it sounds like a lot, doesn’t it!? I can tell you Disney is a different operation now than it was in the 1970s, 80s, or 90s when we all went as kids. Here’s a basic breakdown you can expect for daily expenses when attending the properties.

Disney Lodging: Value resorts range from $118 to $307 per night, while moderate resorts range from $319 to $639 per night. Deluxe resorts can cost anywhere from $560 to over $1,000 per night.

Disney Park Tickets: A one-day ticket for one park costs around $139 for adults and children aged ten and up, while tickets for children aged 3-9 are around $133. Multi-day tickets offer discounts when compared to single-day tickets.

Food at Disney: On average, you should expect to spend between $50-$100 per person per day on food during your stay at Disney World.

See the link to learn more about Disney expenses.

It’s a Different Era

Disney is far more of a global destination now than ever. Hence, park access and accommodations are far more competitive at all times of the year, not to mention inflation impacting traveling costs.

There are ways to take a few thousand off the bottom line, but it adds difficulties to the trip, such as sourcing our travel options to and from the parks and staying at accommodations outside the Disney properties. And, of course, Disney makes the experience much better if you stay within their system, such as access to ride passes, free transportation, food perks, and so on.

My wife and I have decided if you go to Disney, you don’t go half-measure; you just need to bite the bullet for the full experience. So trying to shave 20-25% off the trip’s total cost is not worth it to us, as it could be one of the few times we get an opportunity to go to the parks as a family.

Max Out My SEP IRA or Go to Disney World?

After I crunched some numbers and shared with my wife what it would cost, we both took a moment to consider the alternatives. We considered contributing more funds to our retirement accounts or saving for an epic international trip when the kids are older.

Here are our circumstantial factors to consider:

- I put a healthy % of each paycheck into my SEP, but I put less than the 25% maximum since my income is variable.

- I keep extra cash in reserve until I have a clearer idea of how much I can contribute to retirement accounts at the end of the year.

- My retirement goal is on track, and my forecasted expectation is that we could retire a bit earlier than originally planned.

- We’re not in consumer debt.

- In case of emergencies, I have funds in reserve, good for up to six months.

If we decided to contribute a $13,000 maximum to the SEP instead of the trip, over 20 years of projected growth, I have estimated the investment would be worth a little over $60k by the end of 2043; see chart below:

Not Skipping the Memories or Magic

So I’ve got a spoiler alert for you; we decided to book the trip and couldn’t be happier to do so! While it’s hard to negate that an extra 60k in our retirement would be nice, it’s not worth skipping the memories of kids experiencing the magic of Disney at a young age.

There are moments in time you can only experience once, and seeing my kids feel the magic of Disney is worth it to me any day over having more money in retirement. We deliberated whether we should save the money and let it grow to be used for a trip when the kids are older, like a month-long stay in Africa or something of the like. While that sounds amazing, we ultimately decided to make memories when we can still see the magic light up in our children’s eyes, and they want to spend time with us, not at the hotel swimming pool bar!

How Much Does a Trip to Disney Cost? – Perspective is Everything

Compound interest is such an amazing thing over 20 years; we can easily project how much $13,000 will grow. However, the compound interest a three-year-old will have from the memories of his first Disney World trip is more challenging to quantify. In investing, we talk all the time about the cost of waiting, and right now might be the sweet spot for the trip, given the age of my children.

Money will always be a factor in life, but moments with family, especially young kids, are fleeting, which is why we booked this trip. I want all families to enjoy a trip to Disney and, if not Disney, whatever the preferred destination is, to make memories together.

My job is to help families understand the strategies used to make these trips happen and not sacrifice their retirement plans or put themselves into uncomfortable debt. It’s all about planning and perspective; we can all do it with the right guidance.

To start a conversation, please click the link below to book a call.