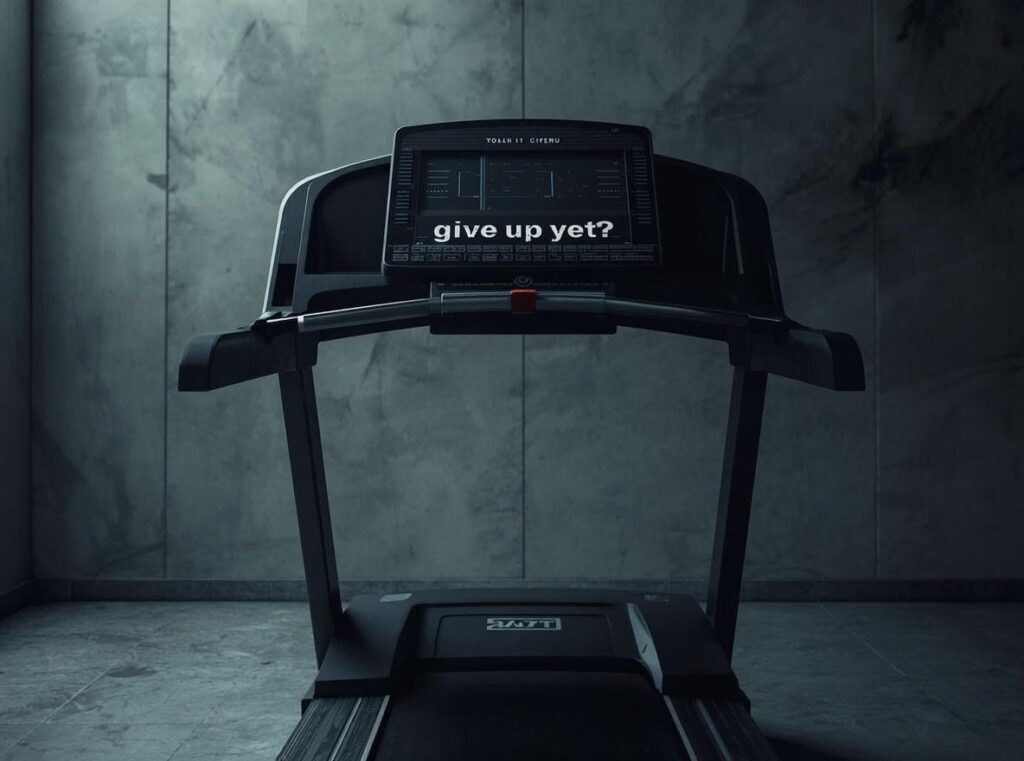

As I’m writing this, we’ve officially passed “Quitter’s Day,” that point in January when most New Year’s resolutions quietly fall apart. The gym crowds thin out, and the greens-focused meal plans fade. And, all the things we told ourselves we’d finally take care of this year get pushed just a little further down the list. It happens every year, like the swallows returning to Capistrano.

We start the new year with the best intentions! We tell ourselves this is the year we’ll get organized, clean things up, and finally address the stuff we’ve been putting off. But intention alone doesn’t create momentum. And writing something down isn’t the same as actually doing it; this is especially true when it comes to financial planning and estate/legacy planning, the things that matter most, but feel easiest to delay.

The Calendar Changes, Habits Don’t

The problem isn’t effort. It’s friction. “I’ll deal with it after the holidays!” quietly turns into “maybe next year.” And before you know it, another year has passed without much progress. The calendar flips, but habits stay the same; this is most evident in estate planning. Wills, health care proxies, powers of attorney, and succession plans are things everyone knows they should have in place, but few people are excited to work on. The conversations feel heavy. The decisions feel final. And avoiding them feels easier in the moment until it isn’t.

Eventually, the cost of waiting shows up. And when it does, it usually arrives at the worst possible time.

Progress Comes From Interia, Not Short-Term Motivations

One of the biggest misconceptions around family financial planning is that you need a perfect plan before you start. You don’t. What you actually need is movement and guidance. Progress is built the same way fitness is: incrementally. Brick by brick/calorie by calorie. One step at a time. You don’t train for a marathon by waking up one morning and running 26 miles. You train by showing up consistently, even when motivation fades (believe me, I’ve done it!) The same applies here.

You don’t need to overhaul everything at once, but you do need to get organized and put structure around the big pieces. I know it’s tough, but you need to start having the conversations that keep getting pushed off. Seeing progress, even little progress, is what creates momentum. And momentum is what keeps people engaged long after January ends.

Estate Planning Starts With Clarity

Estate planning often gets framed as a legal task, but at its core, it’s about clarity. Who handles what? Where does everything live? What happens if something unexpected occurs? Avoiding those questions doesn’t make them go away. It just shifts the burden to someone else later.

Getting things in order doesn’t require attention before anything else; conscious minds and eyes see and review what’s happening and where. This process works best when it’s done gradually and with guidance, rather than all at once under pressure.

I’ve set aside time for ALL of my clients in 2026; it’s my goal to ensure none of them are left with an unnecessary mess. There are so many examples of how badly things can go for all parties involved when no estate plan is in place. Prince died about ten years ago, and his 150+ million-dollar estate took over six years to sort out!

Quick Fixes Rarely Fix Anything!

Every new year comes with the same temptations, the same quick fixes. We hear bold promises of dramatic changes, but we all know they’re too good to be true. It’s why gym memberships spike and fade just as quickly; real progress comes from consistency. The same holds for financial habits. There are no shortcuts and no one-time moves that solve everything (you can’t create a plan around winning the lottery). The people who make the most progress are the ones who keep showing up, make small adjustments along the way, and, above all, ask for guidance and help when they know they need it.

If this feels like the year you want to stop kicking the can down the road, that’s a good place to start. Because change doesn’t happen all at once, it happens when you decide to stop waiting and take the first step forward.

If you need help with that, my door is always open.