For many people, a 401K is their primary retirement savings plan, and they focus on contributing as much as possible as fast as they can. But, reaching the maximum yearly contribution too early may be leaving thousands of dollars on the table.

As a family financial planner, I’m consistently helping clients reevaluate their saving strategies, so they’re not missing opportunities or needlessly putting stringent burdens upon themselves. Maxing out your 401k as quickly as possible, while it may seem like the most obvious way to invest for the future, is not always the most advantageous way to go about it. Let’s explore this subject a little more.

Employer Matching Programs

It’s important to know how your employer chooses to match 401k contributions before deciding how to contribute your own money to the account. Some employers may take the annual salary “lump sum” approach with one or two large contributions to match a year’s worth of your contributions, but this is not commonly offered. However, most 401k employer matches are on a pay-period basis, which is why this blog’s information is significant. You may want to pause before rushing to maximize your 401K contributions if your company matches on a pay-period basis.

Should I Max Out My 401k? The Key Is Spreading Out Contributions Evenly

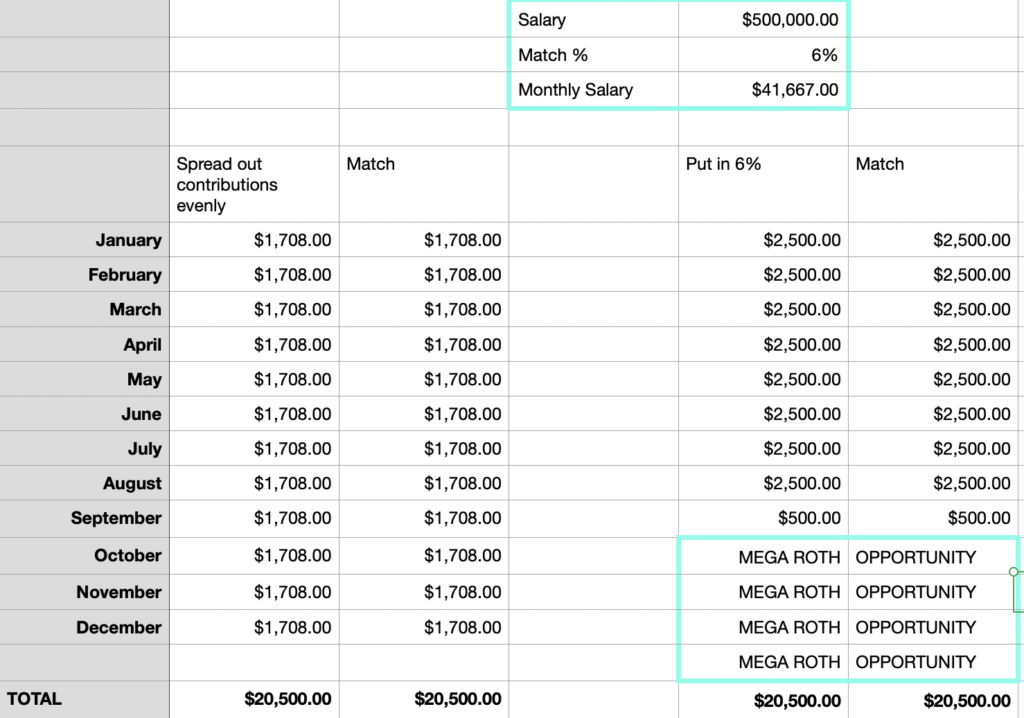

If your employer has a paycheck-to-paycheck matching program, they will match every contribution you make for every pay period, up to the percentage they offer. If they match dollar for dollar up to 6% of your salary, you should take advantage of that and prioritize putting in the entire 6%. Any less, you will be leaving this benefit behind.

Say you have a 6% match; if you under-contribute by putting in 3% per paycheck the first half of the year, you will never get back the money left on the table; and putting in 9% per paycheck in the second half will only get you 6% match of those paychecks. Employer match is based on your salary for that particular pay period. If you put in nothing the first 11 months of the work year and then 100% in December, they will only put 6% of your December salary. As you can see, spreading out contributions evenly over pay periods is very important.

All 401ks have limited funds that can be added each calendar year. Suppose you max out your 401k with your contributions before your employer can match. In this case, you’re missing out on dollars your employer could contribute and keeping less money out of each paycheck for your expenditures or alternative investment opportunities. If you put in more than the 6% and max it out before the end of the year, you will have no eligible contributions left to make; therefore, there will be nothing for the company to match.

By making evenly dispersed contributions throughout the year, your employer can help split the 401k contribution limit instead of you rushing to hit the quota as fast as possible.

To illustrate this point, we’ll use an example of someone making $300,000 a year. Whether this is near or far away from your salary, it will help clarify the point. A common rule is to contribute around 15% of your salary to retirement. If your employer matches 6%, you would contribute $3,750.00 monthly, while your employer contributes $1,500.00.

The 2022 maximum 401K contribution is $20,500. In this scenario, you would reach the max contribution limit in June, and this leaves six months on the table where you could have received employer contributions. Lowering your contribution rate will allow your employer to contribute all year and recoup you $9,000 of unmatched contributions.

I have always said that financial planning should pay for itself. With each initial client meeting, I look at the paystubs for several reasons, but most importantly, to see how much is going into the 401k. Download your stubs now and see if you are not over contributing to your 401k.

While this is the general rule, there’s always an exception. If your income is substantially high, you will not be able to take advantage of the entire match anyway before hitting the contribution limit. In this case, you can simply put in the percent your employer matches to and maximize it out before the end of the year; this could potentially set up an opportunity to take advantage of the “Maga Backdoor Roth IRA.” To learn more, please see my two blogs on this topic.

Mega Backdoor Roth – A Brief Rundown

Mega Backdoor Roth IRA – Banning the Backdoor?

Should I Max Out My 401K?

To make the most of your 401K and have your retirement plan work with your lifestyle, not against it, it is important to make your contributions properly. It may be intimidating to figure this out on your own, but as a family financial planner, I’m always available to help advise on these types of decisions.

If you have a 401k match, this is the first place you should invest for your retirement. Once the match is satisfied, you should keep saving with other investment/retirement vehicles.

If you’re still in the midst of your career, I would suggest prioritizing investment strategies in this order:

1. 401k or Roth 401k to match

2. HSA, if available

3. Roth IRA

4. Build up non-retirement funds to equal six months of expenses

5. Invest in a financial plan

Click the link to see the video on my Tax Control Triangle strategy to learn more.

I always tell my clients my experiences as a family financial planner for my own family have helped me create more informed and nuanced strategies to share with them. I’ve been there, I’ve dealt with the same challenges and experienced the same big milestones. I’m here to provide insights that only come from experience. Please contact me with any questions you have, whether that’s, “How do I start financial planning for my family?” Or “How do I maximize my retirement savings?” I’m here to help clients make informed decisions, regardless of which stage of life they’re in.