As you may know, I’ve recently had my fourth child, a beautiful baby girl, Isla. My wife and I are ecstatic to have our first girl and fourth child, and my wife was particularly excited that she finally had a girl to add some dynamics to our house of boys. Even happier is my mother, who raised my brother and me; this is the first girl, and I can tell Isla will be spoiled rotten.

Having a child is one of the biggest life-altering events anyone can experience. I understand why more young families find it difficult to grasp how they will be able to meet the costly demands of raising a child in today’s economy.

I get it; I’ve been there. It’s daunting thinking about raising a child, let alone financial planning for one too. As a family financial planner, I explain to my clients that my life doesn’t exist in a vacuum outside of the real world; I face the same challenges and economic uncertainties that the entire world does. Oh, how I wish financial planners lived on a planet where supreme beings already solved all questions and concerns about monetary wellbeing, but alas, this isn’t the case.

No, I’ve been there, and I’m still adapting my life plans and goals to roll with the times, but that doesn’t mean I’m aimless, without a map, or guided by fear. Whenever I’m navigating my financial plans, I’m always thinking about what learned insights I can share with my clients to help them to see the best paths forward – this is my job and, above all, my goal.

What Does It Cost to Have a Baby in Massachusetts?

The costs of having a baby are topics I discuss with young families. I often hear, “what does it cost to have a baby?” “Does having a baby make sense with our lifestyle? “Can we afford to have another baby?” “What does saving for college do to our budget now?” These questions are completely sympathetical, and as the news constantly points out, babies can be expensive.

In a recent article featured on Boston.com, a report found that Massachusetts is the most expensive state to have a baby in. According to the report, it costs around $34,000 to have a baby in the Bay State, nearly $20,000 more than Alabama. The reason for higher costs is not healthcare-related but more due to the increase in rent (accommodating for more baby space) and the costs of childcare.

I know what some young would-be parents are thinking right now, “oh great, if this place wasn’t expensive enough as it is, Mass is now the most expensive place to have a baby too!” While the figures can be alarming, I want to say this, if you want to have a baby, don’t hesitate out of financial fears. Fear of the unknown should not be guiding your life decisions. Don’t sacrifice what you want or what you love; a sound plan, confidence in your financial foundations, and a voice of clarity can get you to where you want to go.

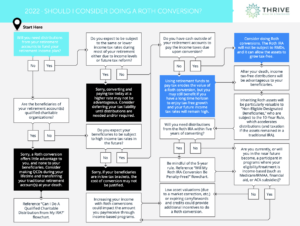

See This Helpful Flow Chart if You’re Thinking About Having a Child: What Issues Should I Consider When Having (Or Adopting) A Child?

Clarity on Your Position

While Massachusetts is an expensive state to live in, there are opportunities here for families that don’t exist elsewhere, even if they’re not always featured in news headlines. For instance, World Population Review has ranked Massachusetts #1 in education and #2 in healthcare across the country. The state is also consistently ranked as one of the most forward-thinking and culturally diverse environments for kids to grow up in – higher costs are not for nothing, and I’m sure many parents across the nation would switch spots in a heartbeat to give their children those opportunities.

My wife and I wouldn’t have decided to have a fourth child if we weren’t confident in our plan(s) and ability to pivot when the circumstances called for it. I’m happy to say that after I sit down with these young families and answer some of their questions on the costs of raising a child, they turn down that internal fear alarm and are relieved to find some perspective on their position.

Don’t sacrifice what you want to do with your life out of fear, especially fear driven by breaking news headlines; there will always be those distractions. Focus on your family’s plan; I’m here to help you follow the map.

Contact me with any questions you may have; I’d love to hear your story and goals.