When I wrote Financial Resolutions back in early 2024, my goal wasn’t to hit a magical number—it was to stay consistent. To treat my health the same way I treat investing: disciplined, flexible, and focused on the long game.

Now, nearly two years later, I can look at the data and say: it’s working.

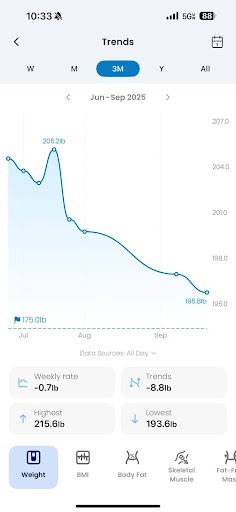

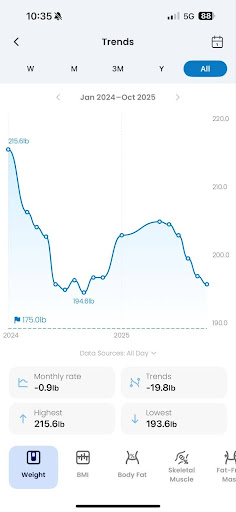

Two charts tell the story. The first shows my weight over the past three months—a few spikes, a few dips, but mostly a steady downward trend—the second zooms out nearly two years, from 215 pounds to under 196.

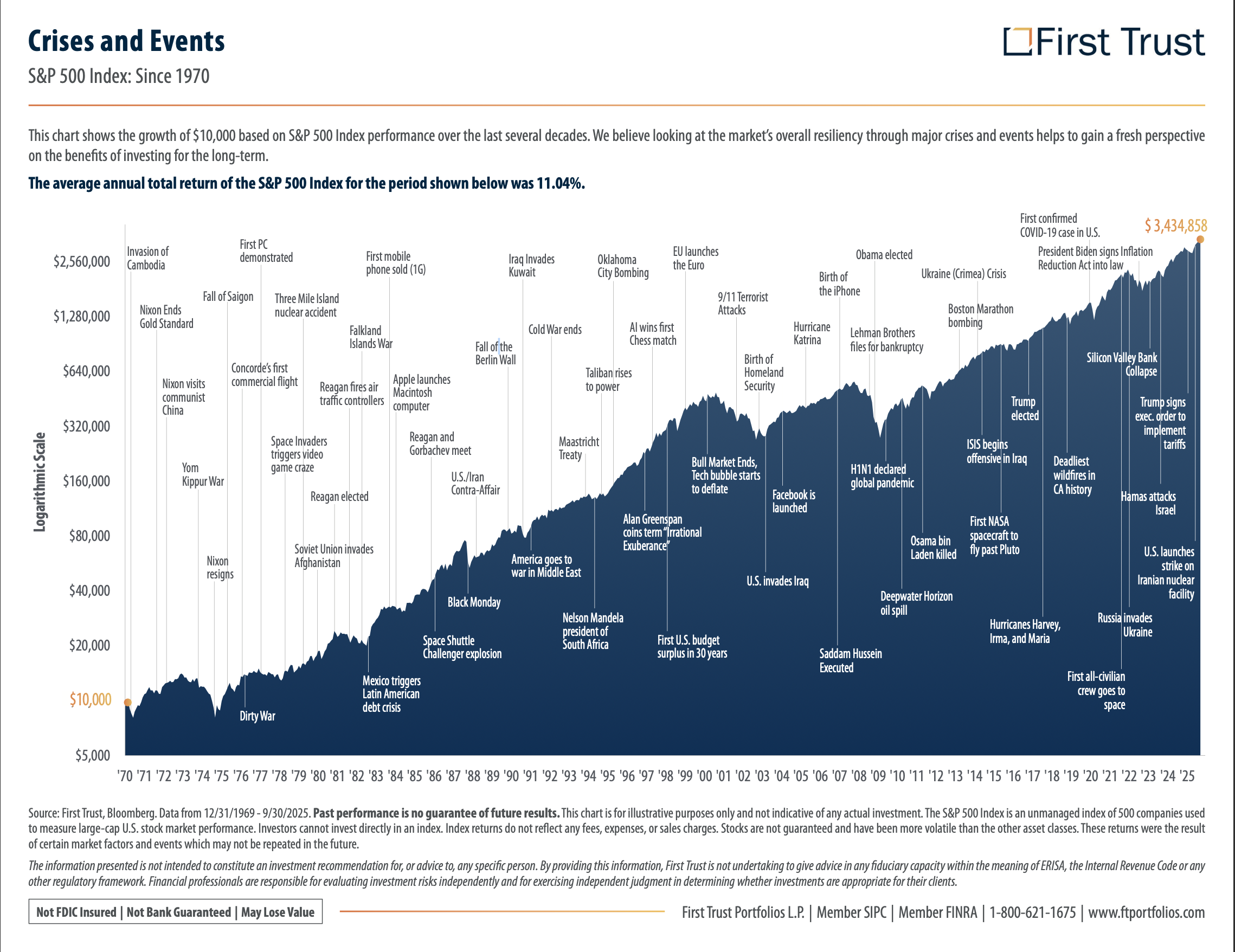

And when I put those next to a year-to-date chart and a 50-year chart of the S&P 500, it’s almost eerie how similar they look. Fortunately, my weight is trending down, and the S&P500 is trending up.

Zoom In: Volatile Markets Happen

That spike in July? That was my Chicago trip. Deep-dish pizza, hotel breakfasts, a few skipped workouts, and an Old Fashioned or two. Totally worth it. Like Liberation Day, I quickly bounced back.

The second chart is zoomed out a bit, and you do not even see that mini-correction. What you do see is late nights at work, a few too many missed workouts, fast food in the car, and another birthday party season, Halloween. By Thanksgiving, things looked like a mini “2008.”

If you only looked at that three-month chart, the plan might be falling apart. But zooming in is always misleading.

Look closely at any short window of the S&P 500, and you’ll see the same thing—volatile markets that feel chaotic in the moment. The Great Depression, the 1970s oil crisis, the Dot-Com crash, 2008, COVID; really, every dip felt permanent, every setback felt defining. But they never were.

Zoom Out: The Trend Always Wins

Step back, and the story changes. Over nearly two years, my weight has trended steadily downward—about one pound a month. It’s not flashy. It’s not perfect. But it’s progress.

The same is true of investing. Over the last century, the stock market has averaged roughly 10% annual returns—but rarely in a straight line. Some years are up 25%, some are down 20%, and during volatile markets, it’s easy to feel like the plan isn’t working. But zoom out far enough, and the long-term trend is undeniable.

All those “crises” flatten into barely noticeable blips on a line that keeps climbing. My “Chicago correction” looks like a short-term bear market. My “Thanksgiving crash” was like a brief panic. And yet by December, the trend recovers because the habits are still intact.

The Same Rules Apply for Diets and Investing – Stay the Course

Whether it’s money or metabolism, the lessons are identical:

- Stay invested. Don’t panic-sell after Thanksgiving dinner.

- Expect volatility. Life happens—pizza, vacations, busy seasons.

- Budget for joy. Enjoy the memories; they’re part of the return.

- Trust the plan. Progress compounds quietly, and it’s not splashy.

Skipping your kid’s ice cream cake to save 300 calories is like trying to time the market; you might win that moment, but you’ll lose what actually matters. The goal isn’t perfection. It’s sustainability.

Progress Tends to Compound

When I started this journey, I wanted to make big, visible changes. But the truth is progress happens in small, consistent efforts. One good decision builds on the next. One walk, one salad, one skipped snack, they compound just like reinvested dividends.

It’s not the grand gestures that move the needle; those are rarely sustainable. It’s the daily habits that become invisible but unstoppable. And just like investing, consistency beats intensity every time.

Enjoy the Ride and The Bird

My goal now is to lose another 20 pounds. But I’m not racing the clock. Because just like investing, this isn’t about getting to the finish line faster; it’s about making the process sustainable enough never to stop.

As we approach Thanksgiving, it’s a good reminder that all these lessons—discipline, patience, perspective—show up at the dinner table, too. You don’t have to wait until January to make new resolutions or big plans. Start now. Be intentional, not restrictive. Enjoy the meal, skip the guilt, and yes—go back for seconds.

Family financial planning and fitness both rely on balance. Knowing when to be strategic and when to live in the moment is the real secret to success. Keep tracking, planning, and showing up—one pound and one market day at a time, but always keep the balance and don’t skip the memories.

Click the Link to Talk Turkey With Scott